Fibonacci Calculator

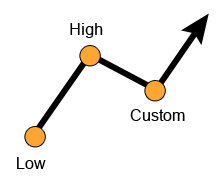

Uptrend Fibonacci Retracement

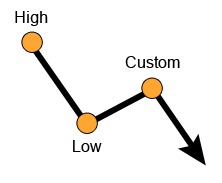

Downtrend Fibonacci Retracement

Fibonacci Calculator - Unlock ThePower Of Technical Analysis

Trade Rebates is pleased to introduce our Fibonacci Calculator, a robust tool designed to help you harness the potential of Fibonacci retracement levels for your trades.

Precision Analysis

Quickly and accurately calculate Fibonacci retracement levels, enhancing your ability to spot potential support and resistance areas.

Simplified Process

Our calculator simplifies the complex calculations, making Fibonacci analysis accessible to traders of all levels.

Confident Trading

With precise retracement levels at your disposal, you can trade with confidence, knowing you have a valuable tool at your fingertips.

Enhance Your Strategy

Incorporate Fibonacci retracement levels into your trading strategy and make more informed decisions.

Refine Your Trading Strategy Now!

Access the Fibonacci Calculator and unlock the potential of technical analysis with Trade Rebates.

FAQs

The Fibonacci calculator is used to identify potential support and resistance levels in a price chart based on Fibonacci retracement and extension levels.

To use it, you typically select two price points on a chart (usually a high and a low) and the calculator will display Fibonacci retracement levels.

Some calculators allow customization of Fibonacci levels, but it depends on the calculator’s features.

Fibonacci retracement levels are widely used by traders, but like any technical analysis tool, their reliability can vary.

Fibonacci extensions are levels beyond 100% and are used to identify potential price targets or areas of price continuation.

Yes, Fibonacci retracement and extension levels can be applied to various financial markets.

Generally, traders look for potential reversals or areas of support and resistance at these levels.

Yes, you can use it for both short (sell) and long (buy) trades by selecting appropriate price points.

Some calculators may provide historical Fibonacci data, allowing you to analyze past price movements.

Best practices include using Fibonacci levels in conjunction with other technical analysis tools and considering market context.